Cultivated meat is getting closer to your plate, thanks to cheaper growth factors. These proteins, crucial for growing meat from cells, have been a major barrier due to their high cost. But new methods are slashing expenses, making cultivated meat more affordable and accessible.

Here’s what you need to know:

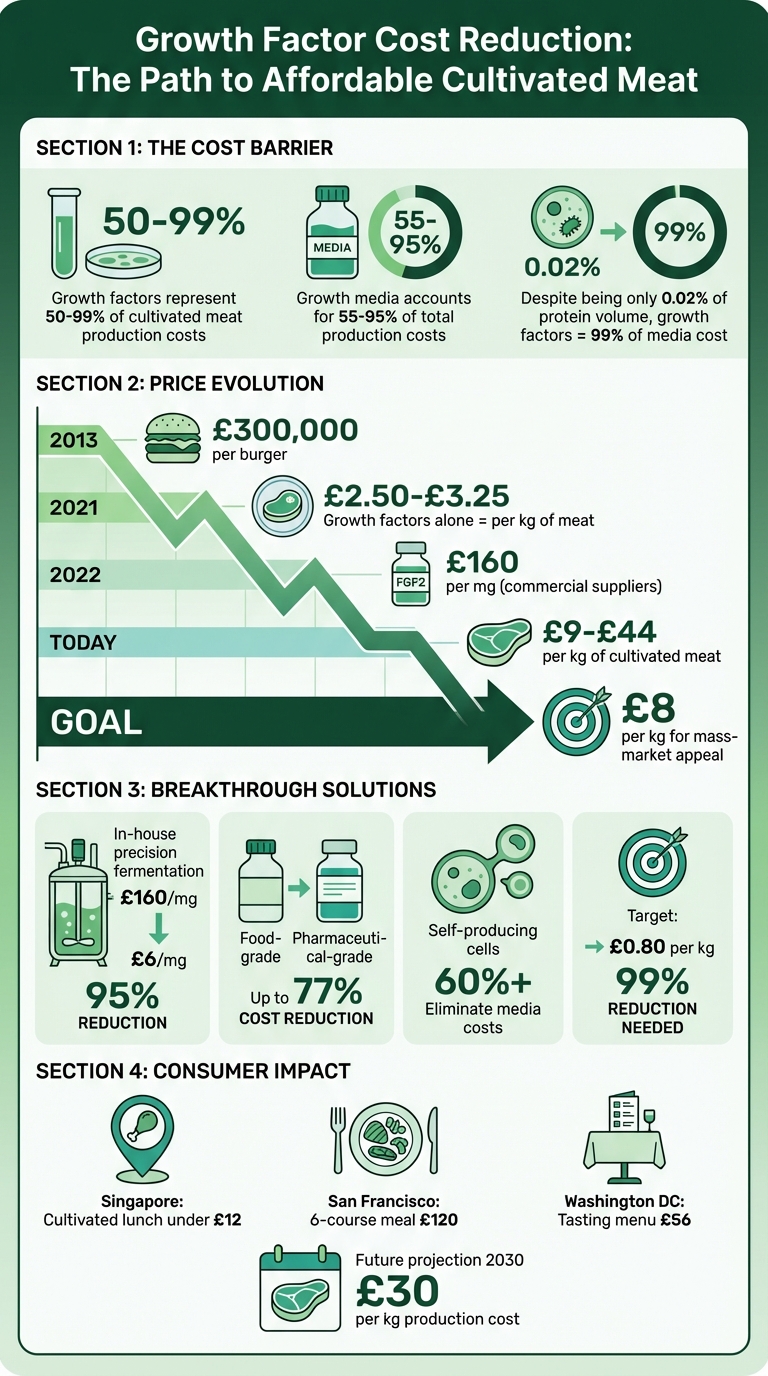

- Growth factors currently make up 50–99% of cultivated meat production costs.

- Prices of key proteins like FGF2 have dropped from £160/mg to £6/mg through in-house production.

- Techniques like precision fermentation and self-producing cells are driving costs down by up to 95%.

- Cultivated meat costs have fallen from £300,000 per burger (2013) to £9–£44/kg today, with a goal of reaching £8/kg for mass-market appeal.

With these advancements, cultivated meat could soon compete with traditional meat in price, offering a sustainable and slaughter-free alternative.

Cultivated Meat Cost Reduction Timeline: From £300,000 to £8 per kg

Cost drivers of cultivated meat production

What Growth Factors Do in Cultivated Meat Production

Growth factors are proteins that naturally signal cells to grow, survive, and develop into specific tissues, like muscle or fat. In the world of cultivated meat, these proteins are added to the cell culture media - a nutrient-rich solution that helps cells grow outside the animal. Essentially, they guide the cells on how to grow and what to become.

The challenge? These proteins are highly unstable, with lifespans ranging from just minutes to a few days. On top of that, they require precise modifications, which makes producing them in large quantities incredibly expensive. Since growth factors play such a critical role in the process, their cost significantly impacts the overall price of cultivated meat.

Why Growth Factors Cost So Much

The steep price of growth factors comes down to where they’re sourced: pharmaceutical-grade suppliers. These companies specialise in producing growth factors for medical purposes, such as stem cell therapies and wound healing, where purity and precision are non-negotiable, and cost isn’t the top priority.

To ensure these proteins are biologically active, pharmaceutical-grade production involves strict quality controls and complex modifications like disulfide bonding and glycosylation. If these processes go wrong, the proteins won’t fold correctly, rendering them useless. This level of refinement is manageable in small lab settings but becomes financially impractical when scaled up to the quantities needed for food production.

For example, as of September 2022, bovine FGF2 - a key growth factor used in cultivated meat - cost about £160 per milligram from commercial suppliers [1]. To put that into perspective, producing just one kilogram of meat could require several grams of this protein, making it a significant cost driver in the process.

How Growth Factor Costs Affect Cultivated Meat Prices

Despite making up only about 0.02% of the total protein volume in the media, growth factors can account for as much as 99% of its cost. With FGF2 priced at around £160 per milligram [1][3], it’s no surprise that growth media represents between 55% and 95% of the total production cost for cultivated meat. In contrast, proteins like albumin, which make up the bulk of the media, are far cheaper on a per-kilogram basis.

"The vast majority of current media costs and a sizable fraction of environmental impacts are incurred by... growth factors and recombinant proteins." - Good Food Institute [3]

In 2021, cost models showed that growth factors alone contributed about £2.50–£3.25 to the cost of producing one kilogram of meat. Even if all other production costs were eliminated, cultivated meat still wouldn’t be able to compete with conventional meat, which is priced at roughly £2 per kilogram [1]. For cultivated meat to hit a more realistic retail price of £8 per kilogram, growth factor costs would need to drop to around £0.80 per kilogram - a daunting 75% reduction from current levels.

This pricing dynamic highlights why cultivated meat remains a niche product rather than an everyday option. Until the cost of growth factors is slashed dramatically, scaling production to meet mass-market demand will remain out of reach.

New Methods That Are Reducing Growth Factor Costs

Scientists and companies are finding new ways to slash the costs of growth factors, making cultivated meat production much more affordable. These methods are helping bridge the gap between lab-grown meat prices and what shoppers typically pay at the supermarket. With these advancements, the industry is tackling earlier cost challenges head-on.

Precision Fermentation and Smarter Manufacturing

Precision fermentation uses microorganisms like bacteria, yeast, or fungi as tiny factories to produce growth factors [3]. Instead of relying on pricey pharmaceutical suppliers, companies can now manufacture these proteins themselves using established industrial fermentation techniques.

For example, researchers have shown that producing growth factors such as TGF-β and FGF2 in-house can cost as little as £6 per milligram, compared to a staggering £160 per milligram when sourced commercially [1]. This shift to in-house production can cut media costs by up to 95% [1]. The savings largely come from switching from pharmaceutical-grade to food-grade standards. Food-grade production has less stringent purity requirements, which significantly reduces costs [6].

To make cultivated meat competitive at around £8 per kilogram, growth factor costs need to drop to about £80,000 per kilogram [3]. While that may still sound high, scaling up production could eventually bring costs down to just £0.08 per gram [2]. This progress is key to making cultivated meat more accessible and affordable for consumers.

Cells That Produce Their Own Growth Factors

Taking things a step further, researchers are working on eliminating the need for external growth factors altogether. In January 2024, a team at Tufts University, led by Andrew Stout and David Kaplan, successfully engineered bovine satellite cells to produce their own FGF2 - a protein that previously made up over 60% of media costs [5][7]. This breakthrough aligns with ongoing efforts to tackle cost barriers in cultivated meat production.

"These kinds of systems offer the potential to dramatically lower the cost of cultured meat production by enlisting the cells themselves to work with us in the processes, requiring fewer external inputs." - Andrew Stout, Lead Researcher, Tufts University [5]

This approach, called autocrine signalling, uses genetic switches to control growth factor production. The cells produce growth factors when they need to multiply and stop when they’re ready to develop into muscle tissue. While the engineered cells take slightly longer to double (60–82 hours without FGF2 compared to 55 hours with it), this trade-off could eliminate one of the biggest cost drivers in cultivated meat production [7].

On top of that, this method simplifies the manufacturing process. Instead of running a separate system to produce, harvest, and purify growth factors, the cells handle everything in one step [5]. This streamlining reduces energy use, equipment, and labour, which ultimately lowers costs for consumers.

sbb-itb-c323ed3

How Lower Costs Benefit Consumers

Recent advancements in growth factor production are starting to make a real difference for consumers. By cutting the costs of these essential components, cultivated meat is transitioning from a luxury item found in exclusive restaurants to something more accessible in supermarkets and online platforms like Cultivated Meat Shop.

More Affordable Prices for Regular Shoppers

Back in 2013, a single cultivated burger came with a jaw-dropping price tag of £300,000. Fast forward to today, and production costs have plummeted to between £9 and £44 per kilogram [2]. While still more expensive than traditional meat, this downward trend is promising. The key to achieving competitive pricing lies in drastically reducing the cost of growth factors.

To match the price of conventional meat - around £1.60 per kilogram - growth factors need to cost no more than £0.18 per kilogram. That's a staggering thousand-fold reduction from current levels [1]. Hitting this target could make cultivated meat available at approximately £8 per kilogram, a price point that could appeal to a much broader audience.

"To make cultivated meat commercially viable, that number [media cost] is probably going to have to be $0.80 per litre or less - so orders of magnitude lower." - David Block, Researcher, UC Davis [6]

One major step forward has been the shift from pharmaceutical-grade to food-grade ingredients. Companies like Mosa Meat, in partnership with Nutreco, have replaced 99.2% of their cell feed with food-grade components while maintaining similar growth rates [4]. This adjustment alone has the potential to slash basal media costs by up to 77% [4]. With these cost-saving measures, cultivated meat is inching closer to becoming an affordable option for everyday shoppers. The next challenge? Scaling up production to meet mass-market demand.

Wider Availability in Shops and Online

Lower costs don’t just mean cheaper prices - they also pave the way for mass production. At the moment, cultivated meat is primarily featured in upscale dining experiences. For example, a six-course meal with cultivated chicken costs about £120 in San Francisco, while a tasting menu in Washington, D.C., is priced at around £56 [6]. In Singapore, where production has advanced further, a cultivated chicken lunch is available for under £12 [6].

As growth factor costs continue to drop, companies are planning large-scale facilities with 100,000-litre bioreactors capable of producing thousands of tonnes of meat annually [6]. This kind of production scale is essential for supplying supermarkets and online retailers. Platforms like Cultivated Meat Shop are already gearing up for this shift, offering waitlists and product previews to ensure British consumers are among the first to access these products.

These cost reductions will also open the door to a wider variety of offerings. Right now, most cultivated meat products are limited to ground meat or hybrid options. But as growth factor costs fall, companies will be able to produce more complex items like marbled steaks, fish fillets, and other speciality cuts [1]. This expanded selection will make cultivated meat a practical choice for a greater range of dishes, catering to diverse tastes and cooking styles.

What to Expect: The Future of Cultivated Meat Pricing

Thanks to strides in precision fermentation and advanced cell systems, the outlook for cultivated meat pricing is becoming brighter. By 2030, improvements in growth factor production could make cultivated meat far more accessible. Current projections estimate that cultivated meat might account for 0.1–0.56% of the global meat market, with production costs potentially dropping to around £30 per kilogram[3].

To achieve a retail price of £8 per kilogram, growth factor costs would need to fall to £0.80 per kilogram, representing roughly 10% of production expenses. This would require a staggering 99% reduction from today’s biopharmaceutical prices[3]. However, advancements in manufacturing techniques and economies of scale are expected to make this possible. For instance, growth factors used in industrial enzymes for detergents already cost as little as £0.08 per gram when produced at scale[2]. These kinds of cost reductions could set the stage for the large-scale production needed to meet consumer demand.

Facilities like Upside Foods’ upcoming 13,000-metric-tonne plant are a step toward scaling up production to supply major UK retailers[6]. As this scaling takes place, initiatives like Cultivated Meat Shop aim to support British consumers by offering waitlists, previews, and educational resources to ease the transition.

Although widespread availability will take time, the trends are clear: cultivated meat could soon move from niche restaurant offerings to everyday grocery shelves. Kevin Kayser, Chief Scientific Officer at Upside Foods, highlighted the importance of raw material costs in this shift:

"One of the reasons I was hired was raw material inputs... When I first started, it was top of the list. You have to work on it now in order to be ready."[6]

For UK shoppers, this means that cultivated meat could become a regular grocery item within the next five to seven years, assuming the industry hits its cost reduction goals and scales production effectively.

FAQs

What role do growth factors play in the cost of cultivated meat?

Growth factors play a crucial role in creating cultivated meat, as they enable cells to grow and multiply. But here's the catch: they're incredibly expensive. These components can contribute anywhere from 8% to 22% of total production costs, which translates to about £2–£3 per kilogram. Even more striking, they can represent up to 99% of the cost of the growth media. This hefty price tag has been a major hurdle in making cultivated meat more budget-friendly for consumers.

Finding ways to bring down the cost of growth factors is essential. It’s a key step toward reducing overall prices and making cultivated meat a more accessible and appealing choice for shoppers in the future.

How is the cost of cultivated meat being reduced for consumers?

The cost of producing cultivated meat is steadily dropping, thanks to progress in several key areas. A notable development is the creation of more affordable culture media. Some of these formulations are now priced between £0.06 and £0.22 per litre, with options that are recyclable or protein-free, significantly cutting production costs.

On top of that, larger, automated bioreactors and food-grade supply chains have boosted efficiency. Advances such as precision-fermented proteins and methods that allow cells to produce their own growth factors are also reducing the need for costly inputs. These innovations are paving the way for cultivated meat to become a more budget-friendly choice for consumers in the future.

When will cultivated meat be available in UK supermarkets?

Cultivated meat is anticipated to hit UK supermarket shelves by early 2027, marking a major shift in how we source our food. Regulatory bodies aim to finalise safety assessments within two years of the March 2025 announcement.

This progress opens the door for consumers to enjoy real meat grown from animal cells - a cutting-edge option that offers a more sustainable way to enjoy meat without traditional farming methods.